"Financial Skills for Teens: A Beginner's Guide to Budgeting, Saving, and Investing" by Jeffrey Simmons empowers teenagers to take control of their financial futures. This comprehensive guide demystifies personal finance, offering practical strategies for budgeting, saving, and investing, even with limited income. From understanding basic financial terminology to navigating online shopping and avoiding debt, the book provides clear, relatable examples and actionable steps. Learn to set financial goals, build credit, and explore side hustles, all while developing healthy money habits. This isn't about instant riches, but about building a solid foundation for long-term financial success and achieving your future aspirations.

Review Financial Skills for teens

"Financial Skills for Teens: A Beginner's Guide to Budgeting, Saving, and Investing" is a breath of fresh air in the often-daunting world of personal finance. Frankly, I was impressed. It's not just another dry textbook; it's a genuinely engaging and accessible guide tailored perfectly for young adults navigating the complexities of money for the first time. What sets this book apart is its remarkable ability to simplify complex financial concepts without sacrificing depth or accuracy. Jeffrey Simmons masterfully avoids overwhelming jargon, instead employing clear, concise language and relatable real-life examples that truly resonate with a teenage audience.

The book's structure is logical and easy to follow. It starts with the fundamentals – budgeting and saving – laying a solid foundation before progressing to more advanced topics like investing and credit building. I particularly appreciated the inclusion of practical strategies that teens can implement immediately, even with limited income. The emphasis on creating a realistic budget and avoiding common financial pitfalls, like impulse buying and falling prey to online scams, is invaluable. It's not just about teaching how to manage money; it's about cultivating healthy financial habits early on.

What I found most refreshing was the book's acknowledgment of the emotional and psychological aspects of money management. The chapters addressing peer pressure and consumer culture are incredibly relevant to teenagers, offering practical advice on navigating these often-challenging situations. This holistic approach goes beyond the purely technical, recognizing that building a strong financial future requires more than just understanding numbers; it requires understanding oneself and one's relationship with money.

Furthermore, the book doesn't shy away from important topics that are often overlooked in similar guides. The sections on investing and credit scores, for instance, demystify these often-intimidating subjects, making them approachable and understandable even for complete beginners. The insightful tips on utilizing technology to assist in financial management, such as leveraging smartphone apps, are incredibly timely and relevant to today’s tech-savvy teens.

While the book doesn't promise overnight riches (a welcome departure from many get-rich-quick schemes), it empowers teens to take control of their financial destinies. It equips them with the knowledge and tools to build a secure financial future, setting them on a path towards long-term financial success and independence. It's a fantastic resource not only for teens themselves but also for parents, educators, and anyone seeking to instill sound financial principles in young people. It’s a must-read for anyone wanting to start their journey towards financial literacy early and confidently. Highly recommended.

Information

- Dimensions: 5.5 x 0.35 x 8.5 inches

- Language: English

- Print length: 154

- Publication date: 2024

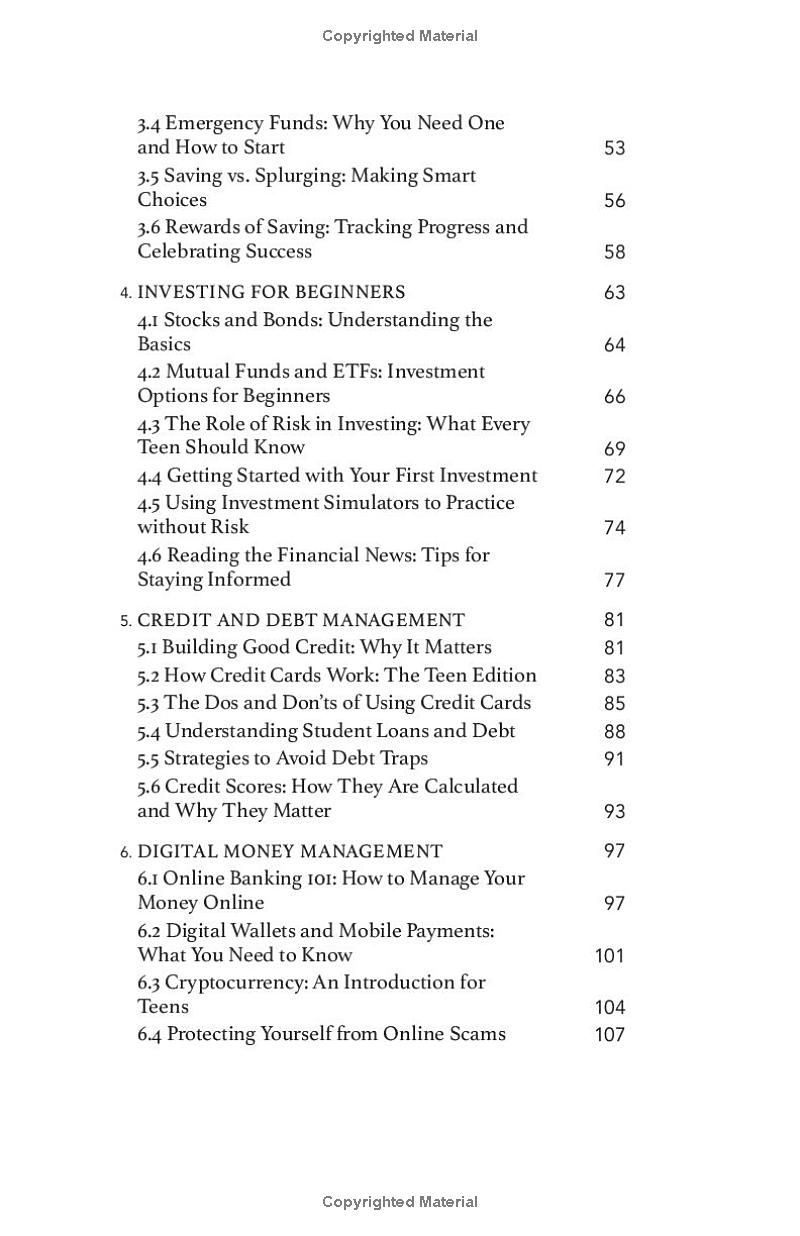

Book table of contents

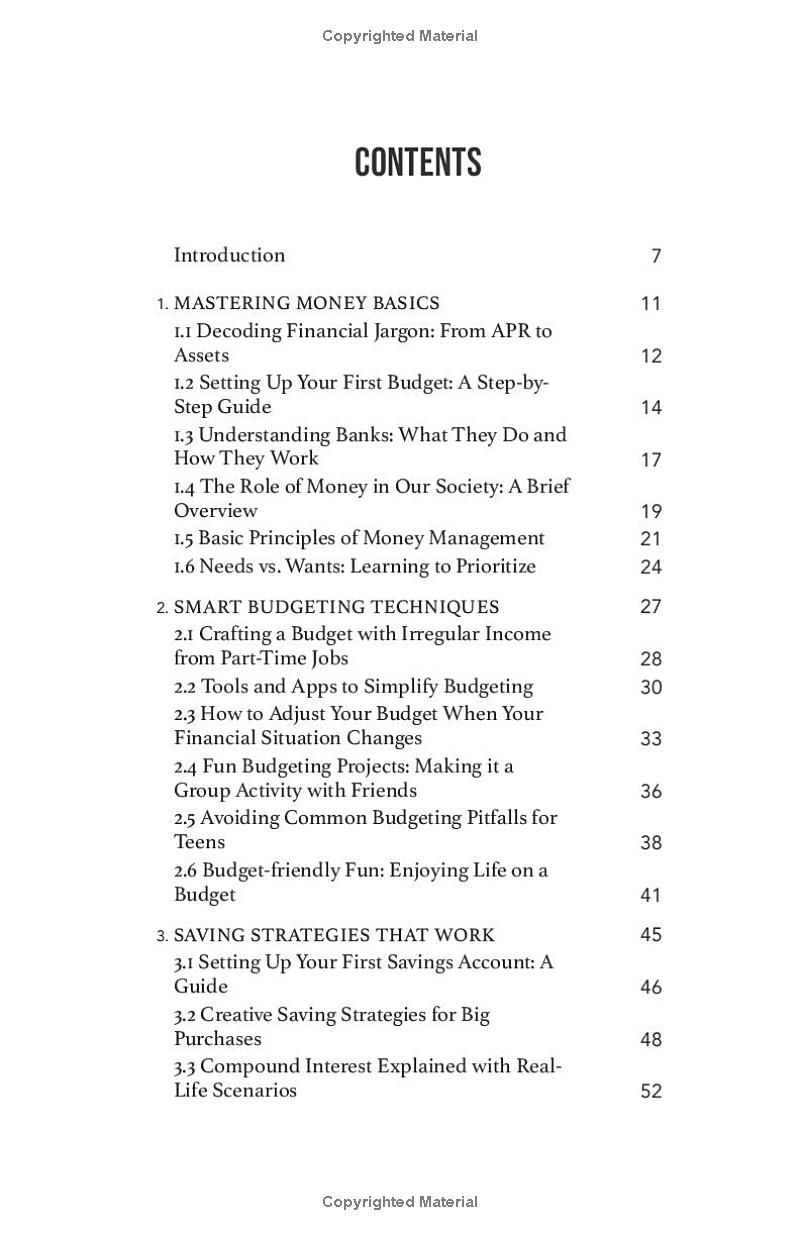

- Introduction

- MASTERING MONEY BASICS

- Decoding Financial Jargon: From APR to Assets

- Setting Up Your First Budget: A Step-by-Step Guide

- Understanding Banks: What They Do and How They Work

- The Role of Money in Our Society: A Brief Overview

- 15 Basic Principles of Money Management

- Needs vs. Wants: Learning to Prioritize

- SMART BUDGETING TECHNIQUES

- Budget with Irregular Income from Part-Time Jobs

- Tools and Apps to Simplify Budgeting

- How to Adjust Your Budget When Your Financial Situation Changes

- Budgeting Projects: Making it a Fun Group Activity with Friends

- Avoiding Common Budgeting Pitfalls for Teens

- Budget-friendly Fun: Enjoying Life on a Budget

Preview Book